What's The Use? Land Use Uncertainty, Real Estate Prices, and the Redevelopment Option

Abstract

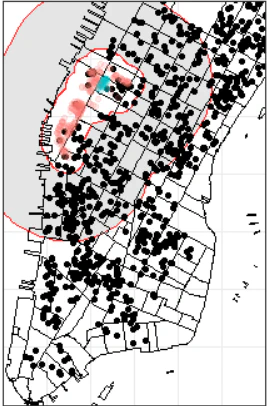

We incorporate uncertainty surrounding future land-use restrictions to empirically assess the option value of redevelopment embedded in real estate prices for New York City (NYC) from 2003-2015. Using a two-stage estimation procedure, we interact predicted probabilities of land-use (re)zoning to either residential, commercial or manufacturing with an additional proxy for the property’s redevelopment propensity. Over the period spanning 2003 to 2015, estimates of the average option value to redevelop in Manhattan and Brooklyn are 20% and 8.5% of total estimated property value, respectively. There is also evidence that manufacturing lots identified as likely to be rezoned by the model sell at an average premium of 50% per square foot. Lastly, we find evidence consistent with the hypothesis that the redevelopment option value is counter-cyclical.

Type

Publication

Working Paper